what to do if you cant afford health insurance 2017

The economical downturn caused by the coronavirus pandemic has renewed attention on health insurance coverage every bit millions have lost their jobs and potentially their wellness coverage. The Affordable Care Human activity (ACA) sought to address the gaps in our wellness care organisation that exit millions of people without health insurance by extending Medicaid coverage to many low-income individuals and providing subsidies for Market coverage for individuals below 400% of poverty. Post-obit the ACA, the number of uninsured nonelderly Americans declined by 20 million, dropping to an historic depression in 2016. However, beginning in 2017, the number of uninsured nonelderly Americans increased for 3 straight years, growing by 2.2 million from 26.vii million in 2016 to 28.9 one thousand thousand in 2019, and the uninsured charge per unit increased from 10.0% in 2016 to ten.9% in 2019.

The hereafter of the ACA is in one case once again before the Supreme Court in California vs. Texas, a example supported by the Trump administration that seeks to overturn the ACA in its entirety. A decision by the Court to invalidate the ACA would eliminate the coverage pathways created by the ACA, leading to significant coverage losses.

Although the number of uninsured has probable increased further in 2020, the data from 2019 provide an important baseline for understanding changes in health coverage leading upward to the pandemic. This issue brief describes trends in health coverage prior to the pandemic, examines the characteristics of the uninsured population in 2019, and summarizes the access and fiscal implications of not having coverage.

| Summary: Fundamental Facts about the Uninsured Population |

| How many people are uninsured? For the tertiary year in a row, the number of uninsured increased in 2019. In 2019, 28.9 million nonelderly individuals were uninsured, an increment of more than than one million from 2018. Coverage losses were driven by declines in Medicaid and non-group coverage and were particularly large among Hispanic people and for children. Despite these recent increases, the uninsured charge per unit in 2019 was essentially lower than it was in 2010, when the first ACA provisions went into event and prior to the full implementation of Medicaid expansion and the establishment of Health Insurance Marketplaces. – Who are the uninsured? – Why are people uninsured? – How does not having coverage affect health care access? – What are the fiscal implications of being uninsured? |

How many people are uninsured?

After several years of coverage gains following the implementation of the ACA, the uninsured rate increased from 2017 to 2019 amid efforts to alter the availability and affordability of coverage. Coverage losses in 2019 were driven by declines in Medicaid and non-group coverage and were larger among nonelderly Hispanic and Native Hawaiians and Other Pacific Islander people. The number of uninsured children also grew significantly.

In spite of the contempo increases, the number of uninsured individuals remains well below levels prior to enactment of the ACA. The number of uninsured nonelderly individuals dropped from more than than 46.five meg in 2010 to fewer than 26.7 million in 2016 before climbing to 28.9 one thousand thousand individuals in 2019. We focus on coverage among nonelderly people since Medicare offers near universal coverage for the elderly, with just 407,000, or less than 1%, of people over historic period 65 uninsured.

Key Details:

- The uninsured charge per unit increased in 2019, continuing a steady upward climb that began in 2017. The uninsured rate in 2019 ticked up to 10.9% from x.4% in 2018 and 10.0% in 2016, and the number of people who were uninsured in 2019 grew by more than than i 1000000 from 2018 and by 2.ii million from 2016 (Figure 1). Despite these increases, the uninsured rate in 2019 remained significantly below pre-ACA levels.

Figure i: Number of Uninsured and Uninsured Rate among the Nonelderly Population, 2008-2019

- Following enactment of the ACA in 2010, when coverage for young adults below age 26 and early Medicaid expansion went into effect, the number of uninsured people and the uninsured charge per unit began to drop. When the major ACA coverage provisions went into upshot in 2014, the number of uninsured and uninsured rate dropped dramatically and continued to fall through 2016 when merely under 27 million people (10.0% of the nonelderly population) lacked coverage (Figure i).

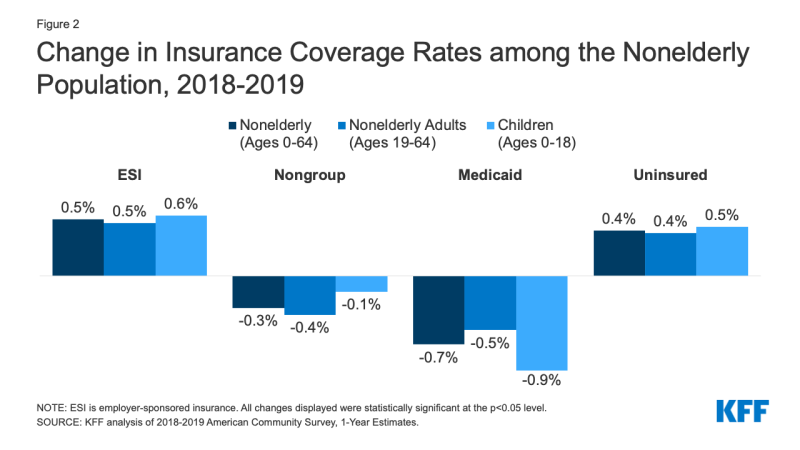

- In 2019, increases in employer-sponsored insurance were offset by declines in Medicaid and non-group coverage resulting in an increase in the number of nonelderly people without insurance. While the number of people covered with employer-sponsored insurance increased by 929,000, or 0.5 percentage points, from 2018 to 2019, the number of nonelderly Medicaid enrollees declined by more than twice that number or 1.9 million people (0.seven percentage points). The drop in Medicaid coverage was larger for children (0.nine pct points) compared to nonelderly adults (0.5 per centum points). In addition, the number of nonelderly people covered in the non-group market besides dropped, by 879,000 from 2018 to 2019 (Figure 2).

Figure ii: Alter in Insurance Coverage Rates among the Nonelderly Population, 2018-2019

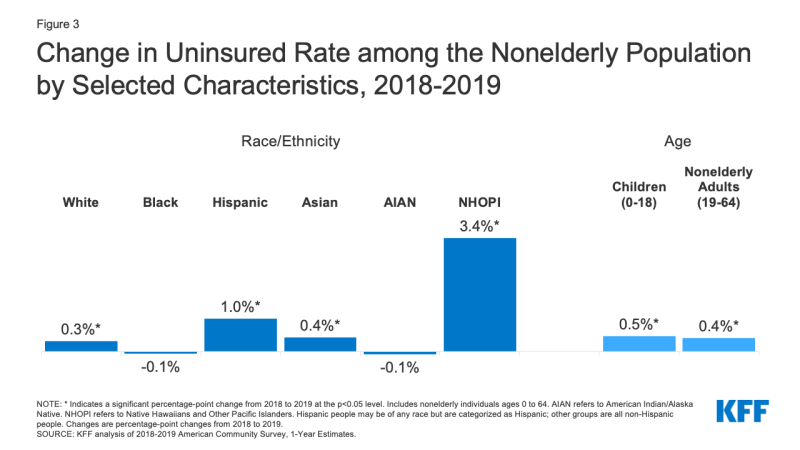

- Hispanic people and Native Hawaiians and Other Pacific Islander people experienced the largest increases in the uninsured in 2019. The uninsured charge per unit grew i percentage point, from 19.0% in 2018 to 20.0% in 2019 for Hispanic people and three.4 per centum points, from 9.3% in 2018 to 12.seven% in 2019 for Native Hawaiians and Pacific Islander people (Effigy 3). While uninsured rates also increased for White and Asian people, the uninsured rates for Blackness and American Indian/Alaska Native people saw no significant change.

Figure 3: Change in Uninsured Rate amid the Nonelderly Population by Selected Characteristics, 2018-2019

- Hispanic people accounted for over half (57%) of the increment in nonelderly uninsured individuals in 2019, representing over 612,000 individuals. Among these uninsured nonelderly Hispanic individuals, more than a third (35%) were children.

- The number of uninsured children grew by over 327,000 from 2018 to 2019 and the uninsured rate for children ticked up well-nigh 0.5 percentage points from simply under 5.1% in 2018 to five.6% in 2019 (Figure 3). While the uninsured rate increased for children of all races and ethnicities, the increase was largest for Hispanic children, growing from eight.one% in 2018 to 9.2% in 2019.

- Changes in the number of uninsured individuals varied across states in 2019. A total of 13 states experienced increases in the number of nonelderly uninsured individuals, including ix Medicaid expansion states and 4 not-expansion states. Nevertheless, the uninsured rate for the group of expansion states was nearly half that of non-expansion states (8.iii% vs. fifteen.5%). Ii states, California and Texas, accounted for 45% of the increase in the number of uninsured individuals from 2018 to 2019. Virginia was the only country to experience a statistically pregnant decrease in the number of uninsured in 2019; the state expanded its Medicaid programme that year (Appendix Table A).

Who are the uninsured?

Most people who are uninsured are nonelderly adults and in working families. Families with low incomes are more than probable to be uninsured. In full general, people of color are more likely to be uninsured than White people. Reflecting geographic variation in income and the availability of public coverage, people who live in the S or W are more likely to exist uninsured. Almost who are uninsured take been without coverage for long periods of time. (See Appendix Table B for detailed data on characteristics of the uninsured population.)

Key Details:

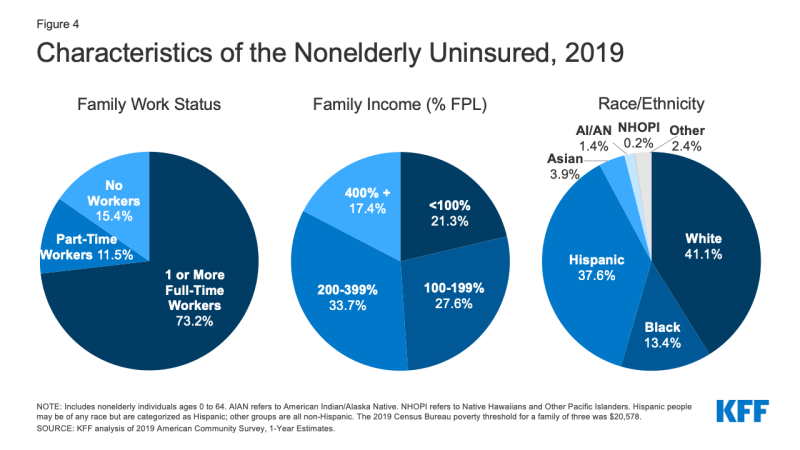

- In 2019, over seven in ten of the uninsured (73.ii%) had at to the lowest degree one full-time worker in their family and an additional 11.v% had a office-time worker in their family (Figure 4).

Figure 4: Characteristics of the Nonelderly Uninsured, 2019

- Individuals with income below 200% of the Federal Poverty Level (FPL)one are at the highest risk of being uninsured (Appendix Table B). In full, more than 8 in ten (82.half-dozen%) of uninsured people were in families with incomes below 400% of poverty in 2019 (Figure 4).

- Almost (85.4%) of the uninsured are nonelderly adults. The uninsured rate amid children was five.6% in 2019, less than one-half the rate amongst nonelderly adults (12.nine%), largely due to broader availability of Medicaid and Scrap coverage for children than for adults (Effigy v).

Figure v: Uninsured Rates among the Nonelderly Population by Selected Characteristics, 2019

- While a plurality (41.i%) of the uninsured are not-Hispanic White people, in full general, people of color are at higher risk of beingness uninsured than White people. People of color brand up 43.1% of the nonelderly U.Due south. population simply account for over one-half of the full nonelderly uninsured population (Figure four). Hispanic, Black, American Indian/Alaska Native, and Native Hawaiians and Other Pacific Islander people all accept significantly college uninsured rates than White people (vii.eight%) (Figure 5). However, like in previous years, Asian people have the lowest uninsured charge per unit at 7.2%.

- Almost of the uninsured (77.0%) are U.Southward. citizens and 23.0% are non-citizens. Yet, non-citizens are more likely than citizens to be uninsured. The uninsured charge per unit for recent immigrants, those who accept been in the U.S. for less than five years, was 29.six% in 2019, while the uninsured rate for immigrants who have lived in the U.s.a. for more than five years was 36.3% (Appendix Table B).

- Uninsured rates vary past state and by region; individuals living in non-expansion states are more likely to be uninsured (Figure v). Xv of the twenty states with the highest uninsured rates in 2019 were not-expansion states as of that year (Figure 6 and Appendix Table A). Economic conditions, availability of employer-sponsored coverage, and demographics are other factors contributing to variation in uninsured rates across states.

- Nearly vii in ten (69.5%) of the nonelderly adults uninsured in 2019 have been without coverage for more than a year.2 People who have been without coverage for long periods may be particularly hard to reach in outreach and enrollment efforts.

Why are people uninsured?

Most of the nonelderly in the U.Due south. obtain health insurance through an employer, but not all workers are offered employer-sponsored coverage or, if offered, tin afford their share of the premiums. Medicaid covers many low-income individuals; however, Medicaid eligibility for adults remains limited in some states. Additionally, renewal and other policies that make it harder for people to maintain Medicaid probable contributed to Medicaid enrollment declines. While fiscal assistance for Marketplace coverage is bachelor for many moderate-income people, few people tin beget to purchase private coverage without financial assistance. Some people who are eligible for coverage under the ACA may non know they tin get help and others may nevertheless detect the cost of coverage prohibitive.

Key Details:

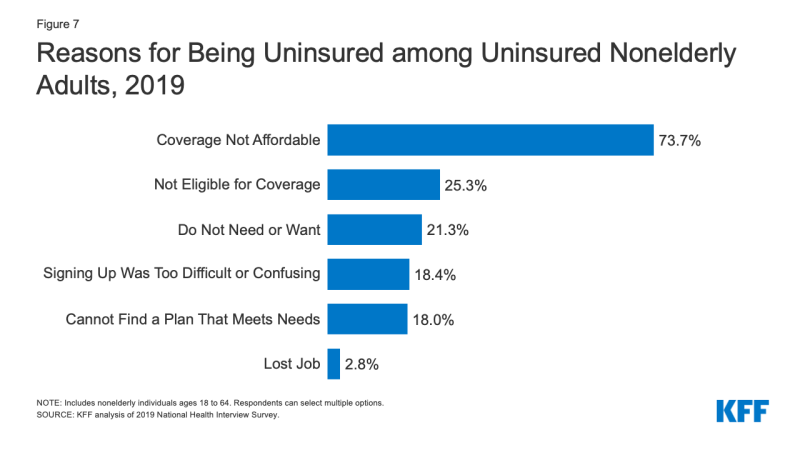

- Cost still poses a major barrier to coverage for the uninsured. In 2019, 73.7% of uninsured nonelderly adults said they were uninsured considering coverage is not affordable, making information technology the most common reason cited for being uninsured (Figure 7).

Figure vii: Reasons for Being Uninsured amidst Uninsured Nonelderly Adults, 2019

- Access to health coverage changes every bit a person's situation changes. In 2019, a quarter of uninsured nonelderly adults said they were uninsured because they were not eligible for coverage, while 21.3% of uninsured nonelderly adults said they were uninsured because they did not need or desire coverage (Figure 7). Nearly one in five were uninsured because they institute signing up was too difficult or disruptive or they could not discover a programme to encounter their needs (18.4% and xviii.0%, respectively).iii Although only 2.8% of uninsured nonelderly adults reported being uninsured due to losing their job in 2019, information technology is likely the number of people who have lost their job and job-based coverage increased in 2020 due to the coronavirus pandemic.

- As indicated above, non all workers have access to coverage through their job. In 2019, 72.v% of nonelderly uninsured workers worked for an employer that did not offer them health benefits.4 Among uninsured workers who are offered coverage past their employers, cost is often a barrier to taking up the offer. From 2010 to 2020, full premiums for family coverage increased by 55%, and the worker's share increased by xl%, outpacing wage growth.5 Depression-income families with employer-based coverage spend a significantly college share of their income toward premiums and out-of-pocket medical expenses compared to those with income above 200% FPL.6

- Medicaid eligibility for adults varies across states and is sometimes express. As of October 2020, 39 states including DC adopted the Medicaid expansion for adults under the ACA, although 34 states had implemented the expansion in 2019. In states that have not expanded Medicaid, eligibility for adults remains limited, with median eligibility level for parents at but 41% of poverty and adults without dependent children ineligible in well-nigh cases. Additionally, state renewal policies and periodic data matches tin can make it hard for people to maintain Medicaid coverage. Millions of poor uninsured adults fall into a "coverage gap" because they earn too much to qualify for Medicaid but not enough to qualify for Market place premium tax credits.

- While lawfully-present immigrants nether 400% of poverty are eligible for Market place tax credits, only those who have passed a v-twelvemonth waiting menstruation later receiving qualified immigration status can qualify for Medicaid. Changes to public accuse policy that permit federal officials to consider use of Medicaid for non-pregnant adults when determining whether to provide certain individuals a dark-green card are likely contributing to coverage declines among lawfully nowadays immigrants. Undocumented immigrants are ineligible for Medicaid or Marketplace coverage.7

- Though financial assist is available to many of the remaining uninsured under the ACA, non everyone who is uninsured is eligible for complimentary or subsidized coverage. Nearly six in ten of the uninsured prior to the pandemic were eligible for financial assist either through Medicaid or through subsidized marketplace coverage. However, over four in x uninsured were outside the reach of the ACA considering their state did not expand Medicaid, their income was too high to qualify for marketplace subsidies, or their immigration status fabricated them ineligible. Some uninsured who are eligible for assist may not be aware of coverage options or may confront barriers to enrollment, and even with subsidies, marketplace coverage may exist unaffordable for some uninsured individuals. While outreach and enrollment assistance helps to facilitate both initial and ongoing enrollment in ACA coverage, these efforts face ongoing challenges due to funding cuts and loftier demand.

How does non having coverage affect health care access?

Health insurance makes a departure in whether and when people become necessary medical intendance, where they get their intendance, and ultimately, how salubrious they are. Uninsured adults are far more likely than those with insurance to postpone health intendance or forgo it birthday. The consequences tin be severe, peculiarly when preventable weather or chronic diseases go undetected.

Key Details:

- Studies repeatedly demonstrate that the uninsured are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.8 , 9 , 10 , 11 More than 2 in five (41.v%) nonelderly uninsured adults reported not seeing a doc or health care professional in the past 12 months. 3 in ten (thirty.two%) nonelderly adults without coverage said that they went without needed intendance in the past year because of toll compared to v.3% of adults with private coverage and ix.v% of adults with public coverage. Role of the reason for poor access among the uninsured is that many (40.eight%) do non take a regular place to become when they are sick or need medical advice (Effigy 8).

Figure 8: Barriers to Health Intendance among Nonelderly Adults past Insurance Condition, 2019

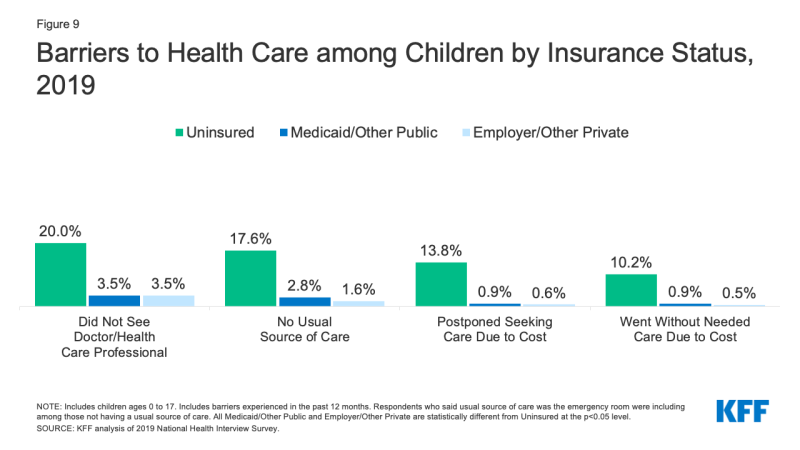

- More than one in ten (ten.2%) uninsured children went without needed care due to price in 2019 compared to less than 1% of children with private insurance. Furthermore, i in five (20.0%) uninsured children had not seen a dr. in the past year compared to 3.five% for both children with public and individual coverage (Figure 9).

Figure 9: Barriers to Health Care amongst Children by Insurance Status, 2019

- Many uninsured people practise not obtain the treatments their health care providers recommend for them because of the cost of intendance. In 2019, uninsured nonelderly adults were more than iii times as likely as adults with private coverage to say that they delayed filling or did not get a needed prescription drug due to cost (xix.8% vs. half dozen.0%).12 And while insured and uninsured people who are injured or newly diagnosed with a chronic condition receive similar plans for follow-upwardly care, people without health coverage are less likely than those with coverage to obtain all the recommended services.13 , 14

- Because people without wellness coverage are less likely than those with insurance to have regular outpatient intendance, they are more than likely to be hospitalized for avoidable health problems and to feel declines in their overall health. When they are hospitalized, uninsured people receive fewer diagnostic and therapeutic services and likewise accept higher bloodshed rates than those with insurance.xv , 16 , 17 , 18 , xix

- Research demonstrates that gaining health insurance improves access to wellness intendance considerably and diminishes the agin effects of having been uninsured. A comprehensive review of enquiry on the furnishings of the ACA Medicaid expansion finds that expansion led to positive furnishings on admission to care, utilization of services, the affordability of care, and financial security among the low-income population. Medicaid expansion is associated with increased early-phase diagnosis rates for cancer, lower rates of cardiovascular mortality, and increased odds of tobacco cessation.20 , 21 , 22

- Public hospitals, community clinics and health centers, and local providers that serve underserved communities provide a crucial wellness care safety cyberspace for uninsured people. However, rubber internet providers have limited resources and service chapters, and not all uninsured people have geographic access to a prophylactic net provider.23 , 24 , 25 High uninsured rates likewise contribute to rural hospital closures, leaving individuals living in rural areas at an fifty-fifty greater disadvantage to accessing care.

What are the financial implications of being uninsured?

The uninsured ofttimes face unaffordable medical bills when they do seek intendance. These bills can quickly translate into medical debt since about of the uninsured have low or moderate incomes and accept niggling, if any, savings.26 , 27

Primal Details:

- Those without insurance for an entire agenda year pay for nearly half of their intendance out-of-pocket.28 In addition, hospitals often accuse uninsured patients much college rates than those paid by private wellness insurers and public programs.29 , 30 , 31

- Uninsured nonelderly adults are much more than probable than their insured counterparts to lack confidence in their power to afford usual medical costs and major medical expenses or emergencies. More than than three quarters (75.six%) of uninsured nonelderly adults say they are very or somewhat worried well-nigh paying medical bills if they become sick or accept an blow, compared to 47.6% of adults with Medicaid/other public insurance and 46.1% of privately insured adults (Figure 10).

- Medical bills can put groovy strain on the uninsured and threaten their fiscal well-being. In 2019, nonelderly uninsured adults were well-nigh twice as likely equally those with private insurance to accept issues paying medical bills (24.one% vs. 11.6%; Effigy 10).32 Uninsured adults are also more likely to face up negative consequences due to medical bills, such as using up savings, having difficulty paying for necessities, borrowing money, or having medical bills sent to collections resulting in medical debt.33

Effigy 10: Problems Paying Medical Bills by Insurance Status, 2019

- Though the uninsured are typically billed for medical services they utilise, when they cannot pay these bills, the costs may go bad debt or uncompensated care for providers. State, federal, and individual funds defray some only not all of these costs. With the expansion of coverage under the ACA, providers are seeing reductions in uncompensated care costs, especially in states that expanded Medicaid.

- Research suggests that gaining health coverage improves the affordability of care and financial security among the depression-income population. Multiple studies of the ACA have found larger declines in problem paying medical bills in expansion states relative to not-expansion states. A split up written report plant that, amidst those residing in areas with high shares of low-income, uninsured individuals, Medicaid expansion significantly reduced the number of unpaid bills and the amount of debt sent to 3rd-political party collection agencies.

Decision

The number of people without health insurance grew for the third year in a row in 2019. Recent increases in the number of uninsured nonelderly individuals occurred amid a growing economy and before the economic upheaval from the coronavirus pandemic that has led to millions of people losing their jobs. In the wake of these record job losses, many people who accept lost income or their job-based coverage may qualify for expanded Medicaid and subsidized market coverage established by the ACA. In fact, recent information betoken enrollment in both Medicaid and the Marketplaces has increased since the beginning of the pandemic. However, it is expected the number of people who are uninsured has increased further in 2020.

Drops in coverage among Hispanic people drove much of the increase in the overall uninsured rate in 2019. Changes to the Federal public charge policy may be contributing to declines in Medicaid coverage among Hispanic adults and children, leading to the growing number without health coverage. These coverage losses as well come as COVID-19 has striking communities of colour unduly hard, leading to higher shares of cases, deaths, and hospitalizations among people of colour. The lack of wellness coverage presents barriers to accessing needed care and may lead to worse wellness outcomes for those afflicted by the virus.

Even as the ACA coverage options provide an important rubber net to people losing jobs during the pandemic, a Supreme Courtroom ruling in California vs. Texas could have major effects on the entire health care arrangement. If the court invalidates the ACA, the coverage expansions that were central to the constabulary would be eliminated and would consequence in millions of people losing health coverage. Such a large increase in the number of uninsured individuals would contrary the gains in admission, utilization, and affordability of intendance and in addressing disparities achieved since the law was implemented. These coverage losses coming in the heart of a public health pandemic could further jeopardize the health of those infected with COVID-19 and exacerbate disparities for vulnerable people of color.

Source: https://www.kff.org/uninsured/issue-brief/key-facts-about-the-uninsured-population/

0 Response to "what to do if you cant afford health insurance 2017"

Post a Comment